The DXY Index and Its Relation to the Indian Equity Market: A Historical Perspective

The DXY Index and Its Relation to the Indian Equity Market: A Historical Perspective

The DXY Index, or the U.S. Dollar Index, is a measure of the value of the U.S. dollar relative to a basket of six major currencies: the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc. It plays a crucial role in the global financial markets as a key indicator of the strength of the U.S. dollar. Investors and analysts closely monitor the DXY index for insights into the potential direction of the dollar, which often influences other markets, including emerging markets like India.

Understanding the DXY and its Impact on the Indian Equity Market

The relationship between the DXY Index and the Indian equity market, particularly the Nifty 50 and Sensex indices, is intricate. The Indian stock market, like many emerging markets, is influenced by the global financial landscape, and the U.S. dollar plays a significant role in shaping investor sentiment and capital flows.

- Strong U.S. Dollar (Rising DXY):

- A rising DXY Index generally signals a strengthening of the U.S. dollar against other currencies. When the U.S. dollar strengthens, it can lead to several consequences for emerging markets like India.

- Capital Outflows: A stronger dollar often leads to capital outflows from emerging markets as global investors shift their investments to the U.S. equities, which may be seen as more stable during periods of dollar strength. This can lead to pressure on the Indian stock market, as foreign portfolio investors (FPIs) may pull out funds, causing a potential decline in stock prices.

- Currency Depreciation: As the U.S. dollar strengthens, the Indian rupee may weaken. A depreciating rupee can increase inflationary pressures in India, raising the cost of imports, particularly crude oil, which in turn can hurt the profitability of Indian companies. This can have a negative effect on the Indian equity market.

- Weak U.S. Dollar (Falling DXY):

- Conversely, when the DXY Index falls and the U.S. dollar weakens, it typically leads to capital inflows into emerging markets like India. Investors may seek higher returns in Indian equities due to the relatively attractive valuations and growth potential of Indian companies.

- Positive Sentiment: A weaker dollar may improve investor sentiment in emerging markets, boosting foreign investments in Indian stocks. Additionally, a weaker rupee can make Indian exports cheaper, benefiting companies in the export sector, which can positively impact their stock prices.

- Cheaper Import Costs: A weaker dollar can help reduce the cost of imports, including oil, which would ease inflationary pressures and support the profitability of Indian companies. This may create a favorable environment for growth in the Indian equity market.

Historical Performance of the Indian Equity Market Against the DXY Index

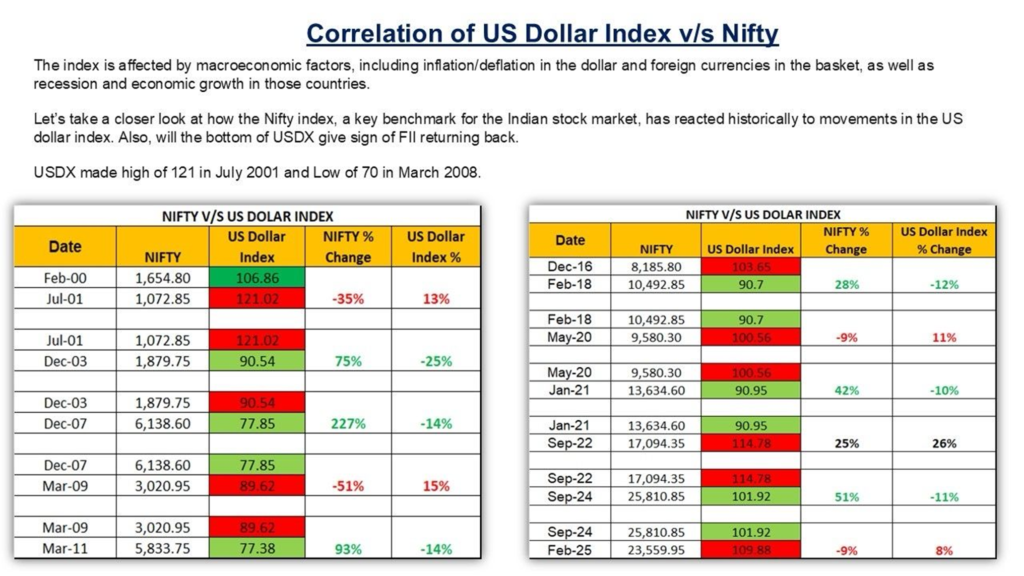

Over the years, the Indian stock market has often demonstrated an inverse relationship with the DXY Index. For example:

- During periods when the DXY Index surged, especially during times of global economic uncertainty or U.S. interest rate hikes, India’s equity markets have faced downward pressure. This is primarily due to capital outflows, a rising dollar, and an appreciating dollar affecting Indian companies’ costs and profit margins.

- On the other hand, when the DXY Index declined, particularly when the U.S. Federal Reserve reduced interest rates or during global liquidity booms, Indian equities have experienced growth. The liquidity flow into Indian markets tends to rise, supporting stock prices and attracting foreign investments.

Notable Events in the Past Decade

- 2013 Taper Tantrum:

- During the Taper Tantrum (when the U.S. Federal Reserve announced it would reduce its bond-buying program), the DXY Index rose significantly, leading to a depreciation of the Indian rupee and a fall in the Sensex and Nifty. This period saw capital outflows from India as investors moved to the U.S. for better returns.

- Post-COVID Recovery (2020-2021):

- After the pandemic, there was a global liquidity surge, and the DXY Index weakened. During this time, Indian equities saw a significant rally, with the Nifty 50 and Sensex reaching record highs due to inflows from both foreign and domestic investors. The weaker dollar supported risk appetite and buoyed investor sentiment.

Conclusion

In summary, while the relationship between the DXY Index and the Indian equity market is complex, there are distinct patterns that have emerged over the years. A stronger U.S. dollar, as indicated by a rising DXY Index, often signals a challenging period for Indian equities, with increased capital outflows and currency depreciation. On the other hand, a weaker dollar can provide a favorable environment for the Indian stock market, with capital inflows and improved corporate profitability.

However, it’s important to remember that while the DXY is an influential factor, other macroeconomic variables such as domestic economic growth, corporate earnings, and geopolitical developments also play crucial roles in shaping the performance of the Indian equity market. Thus, investors should consider the DXY as one of many factors when making decisions related to Indian stocks.

![]()