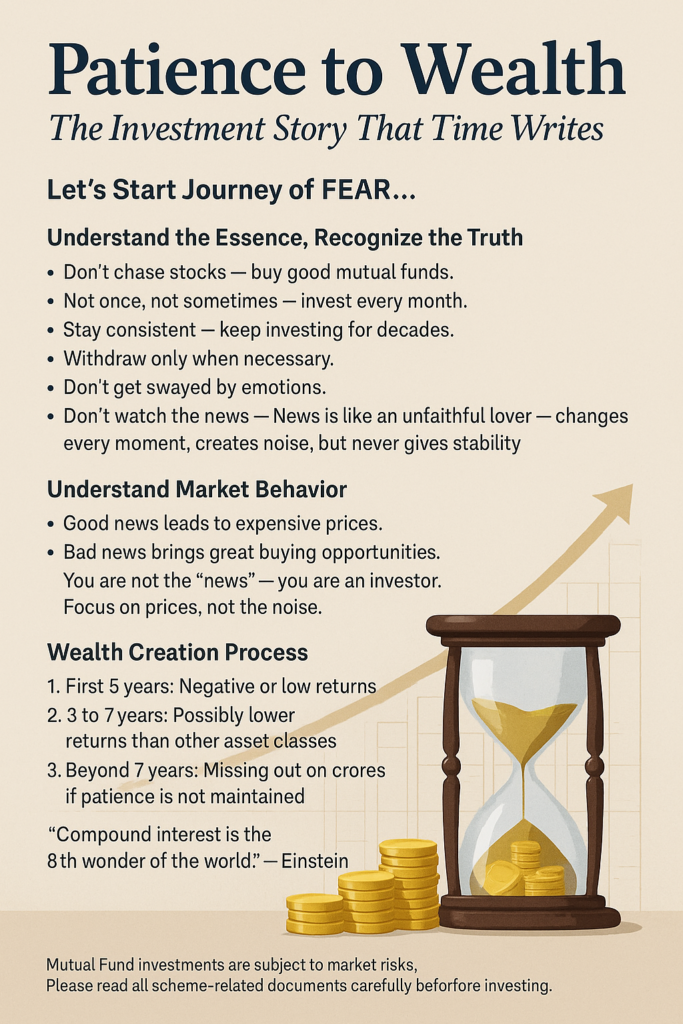

Understand the Essence, Recognize the Truth:

- Don’t chase stocks — buy good mutual funds.

- Not once, not sometimes — invest every month.

- Stay consistent — keep investing for decades.

- Withdraw only when necessary.

- Don’t get swayed by emotions.

- Don’t watch the news — News is like an unfaithful lover — changes every moment, creates noise, – but never gives stability.

Understand Market Behavior:

- Good news leads to expensive prices.

- Bad news brings great buying opportunities.

- You are not the “news” — you are an investor.

Focus on prices, not the noise.

Wealth Creation Process:

- First 5 years: Negative or low returns

- 3 to 7 years: Possibly lower returns than other asset classes

- Beyond 7 years: Missing out on crores if patience is not maintained

“Compound interest is the 8th wonder of the world.” – Einstein

Nippon India Growth Fund – Example Purpose Only

🔹 Lumpsum Investment

- Investment Date: 8th October, 1995 (NAV: ₹10)

- Amount Invested: ₹1,00,000

- Units: 10,000

- NAV as on 16 April, 2025: ₹3,734.445

- Current Value: ₹3,73,44,450 (₹3.73 Cr)

- Highest Value: ₹4,28,04,360 (₹4.28 Cr on 24/09/2024)

🔹 SIP Investment

- Monthly SIP: ₹10,000

- Total Installments: 355

- Total Investment: ₹35,50,000

- Units Accumulated: 64,143.235

- Market Value: ₹23,95,39,382 (₹23.95 Cr)

| Journey OF Nippon India Growth Fund – SIP Data -Example Purpose Only | ||||||||

| Date | Amt. | NAV | Unit | Cumulative Unit | Cumulative Amt. | Valuation | Analysis | Reason |

| 08/10/1995 | 10,000.00 | 10 | 1,000.00 | 1,000.00 | 10,000.00 | 10,000.00 | ||

| 03/02/1997 | 10,000.00 | 10.26 | 974.66 | 15,490.41 | 1,60,000.00 | 1,58,931.61 | Fear | -1,068.39 |

| 01/03/2000 | 10,000.00 | 45.54 | 219.59 | 40,225.23 | 5,30,000.00 | 18,31,856.97 | Greed | |

| 01/10/2001 | 10,000.00 | 16.73 | 597.73 | 48,465.61 | 7,20,000.00 | 8,10,829.66 | Fear | -10,21,027.31 |

| 01/01/2008 | 10,000.00 | 476.85 | 20.97 | 60,664.83 | 14,70,000.00 | 2,89,28,024.19 | Greed | |

| 02/03/2009 | 10,000.00 | 190.47 | 52.5 | 61,177.72 | 16,10,000.00 | 1,16,52,324.56 | Fear | -1,72,75,699.63 |

| 01/12/2010 | 10,000.00 | 504.75 | 19.81 | 61,717.75 | 18,20,000.00 | 3,11,51,972.59 | Greed | |

| 02/01/2012 | 10,000.00 | 364.41 | 27.44 | 62,018.74 | 19,50,000.00 | 2,26,00,497.12 | Fear | -85,51,475.47 |

| 01/01/2013 | 10,000.00 | 505.38 | 19.79 | 62,290.89 | 20,70,000.00 | 3,14,80,283.45 | Greed | |

| 01/08/2013 | 10,000.00 | 399.74 | 25.02 | 62,447.54 | 21,40,000.00 | 2,49,62,673.48 | Fear | -65,17,609.97 |

| 02/03/2015 | 10,000.00 | 834.85 | 11.98 | 62,778.87 | 23,30,000.00 | 5,24,10,719.89 | Greed | |

| 01/03/2016 | 10,000.00 | 687.78 | 14.54 | 62,930.78 | 24,50,000.00 | 4,32,82,764.71 | Fear | -91,27,955.18 |

| 01/01/2018 | 10,000.00 | 1,206.48 | 8.29 | 63,165.73 | 26,70,000.00 | 7,62,08,461.54 | Greed | |

| 01/04/2020 | 10,000.00 | 812.75 | 12.3 | 63,414.91 | 29,40,000.00 | 5,15,40,658.35 | Fear | -2,46,67,803.19 |

| 01/01/2021 | 10,000.00 | 1,410.48 | 7.09 | 63,496.52 | 30,30,000.00 | 8,95,60,571.53 | Greed | |

| 01/11/2021 | 10,000.00 | 2,095.84 | 4.77 | 63,553.98 | 31,30,000.00 | 13,31,99,132.33 | Greed | |

| 01/12/2021 | 10,000.00 | 2,009.98 | 4.98 | 63,558.96 | 31,40,000.00 | 12,77,52,149.44 | Fear | -54,46,982.89 |

| 02/03/2022 | 10,000.00 | 1,948.42 | 5.13 | 63,573.74 | 31,70,000.00 | 12,38,68,543.57 | Fear + | -93,30,588.76 |

| 01/09/2022 | 10,000.00 | 2,154.02 | 4.64 | 63,603.63 | 32,30,000.00 | 13,70,03,459.29 | Profit book | |

| 03/10/2022 | 10,000.00 | 2,116.05 | 4.73 | 63,608.36 | 32,40,000.00 | 13,45,98,540.15 | Force Profit | |

| 01/10/2024 | 10,000.00 | 4,267.17 | 2.34 | 63,694.91 | 34,80,000.00 | 27,17,96,779.80 | Greed | |

| 03/03/2025 | 10,000.00 | 3,431.06 | 2.91 | 63,707.89 | 35,30,000.00 | 21,85,85,663.14 | Fear | -5,32,11,116.66 |

| Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. | ||||||||

💭 The Irony of Human Behavior:

Despite massive long-term performance, many investors earned even less than FDs, some even faced losses —

because they let emotions lead the way, not logic.

🌱 Let’s Be Boring Investors.

- No hurry.

- No clever tricks.

- Just — patience, consistent investing, and time.

That’s the real path to:

Wealth, a worry-free life, and true freedom.

“Stock market is a device to transfer wealth from the impatient to the patient.” – Warren Buffett

One Final, But Crucial Thought:

Think of this like an exam paper — Everyone gets the same questions,

but the irony is 95% fail …. Let’s see who score and pass with wealth creation???

The story is the same. – The data is remarkable – India’s future is bright.

Now the question is: – Who will truly create wealth in the next 25 years???

The Challenge: Sayam (Patience)

Ask yourself:

- Am I prepared to sit tight for the next 25 years?

- Am I willing to manage my emotions during this period?

- Can I handle seeing my portfolio in the red for 5 straight years?

- Can I endure the opportunity cost potentially worth crores every few years?

If your answer is YES, then wealth creation through equity investing is not only possible—it’s probable.

But if your answer is NO, and you expect smooth, linear returns of 12–15% every year, equity may not be the right asset class for you.

It is unrealistic—and frankly, dangerous—to assume markets will deliver consistent, predictable returns every year.

Believe me — the data clearly shows that 95% will fail.

I urge you — even plead with you — be a patient investor.

Previous generations could claim they didn’t know the power of compounding.

But we can’t give that excuse to our next generation.

Because now, the truth is already written — I’ve put it on paper.

The choice is yours.

Be wise. Be patient. Build wealth.

Let’s start Journey of FEAR

F.E.A.R.: “Forget Everything and Run” To F.E.A.R: “Face Everything and Rise”

Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.

![]()