Goal: ₹100 Crore (₹1 Billion) Wealth for Your Child

Formula: ₹35,000 SIP → 25 Years Investment → 25 Years Holding

Assumption: 12% Annual Return | Start at Birth

Rule

100 Cr : The 35-25-25 Rule Explained

50 Cr : The 17.5-25-25 Rule

25 Cr : The 8.7 -25-25 Rule

| Target Wealth | SIP Amount | Investment Period | Holding Period |

| ₹100 Crore | ₹35,000 | 25 Years | 25 Years |

| ₹50 Crore | ₹17,500 | 25 Years | 25 Years |

| ₹25 Crore | ₹8,750 | 25 Years | 25 Years |

With disciplined investing, your child could be a billionaire by age 50.

Fund Growth Over Time (₹35K SIP @ 12%)

| Child’s Age | Total Invested | Market Value | Total Return | Net Gain (Return – Investment) |

| 1 | ₹4.20 Lakhs | ₹4.46 Lakhs | ₹26.8K | ₹-3.93 Lakhs |

| 5 | ₹21 Lakhs | ₹28.39 Lakhs | ₹7.39 Lakhs | ₹-13.61 Lakhs |

| 10 | ₹42 Lakhs | ₹78.41 Lakhs | ₹36.41 Lakhs | ₹-5.59 Lakhs |

| 15 | ₹63 Lakhs | ₹1.66 Crores | ₹1.03 Crores | ₹40.57 Lakhs |

| 20 | ₹84 Lakhs | ₹3.22 Crores | ₹2.38 Crores | ₹1.54 Crores |

| 25 | ₹1.05 Crores | ₹5.98 Crores | ₹4.93 Crores | ₹3.88 Crores |

| 30 | ₹1.05 Crores | ₹10.50 Crores | ₹9.45 Crores | ₹8.40 Crores |

| 35 | ₹1.05 Crores | ₹18.50 Crores | ₹17.45 Crores | ₹16.40 Crores |

| 40 | ₹1.05 Crores | ₹32.61 Crores | ₹31.56 Crores | ₹30.51 Crores |

| 45 | ₹1.05 Crores | ₹57.47 Crores | ₹56.42 Crores | ₹55.37 Crores |

| 50 | ₹1.05 Crores | ₹101.28 Crores | ₹100.23 Crores | ₹99.18 Crores |

Total Investment: ₹1.05 Crore

Final Market Value: ₹101.28 Crore

Compounding accelerates after 25 years — just stay invested.

Not Starting at Birth? No Problem!

You can adjust your SIP or Lumpsum based on your child’s age:

| Child Age | For ₹100 Cr | For ₹50 Cr | For ₹25 Cr |

| 5 Years | ₹28.39 Lakhs / ₹35K SIP | ₹14.19 Lakhs / ₹17.5K SIP | ₹7.10 Lakhs / ₹8.75K SIP |

| 10 Years | ₹78.41 Lakhs / ₹35K SIP | ₹39.21 Lakhs / ₹17.5K SIP | ₹19.60 Lakhs / ₹8.75K SIP |

| 15 Years | ₹1.67 Cr / ₹35K SIP | ₹83.29 Lakhs / ₹17.5K SIP | ₹41.64 Lakhs / ₹8.75K SIP |

“But 50 Years Feels Too Long!”

If Answer of the above question is Yes, then

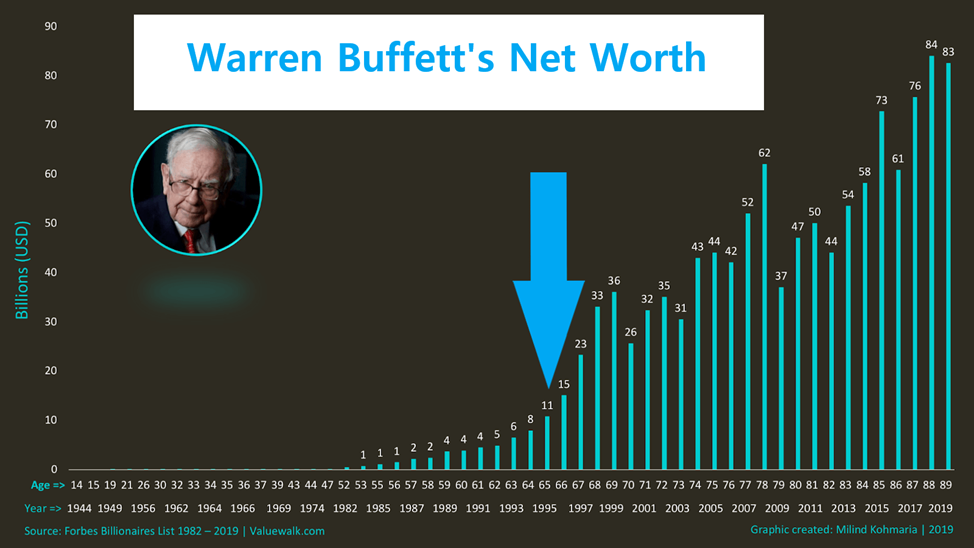

Warren Buffett’s Journey:

- Started investing at age 14

- Massive wealth came after age 64 (After 50 Years)

“Someone is sitting in the shade today because someone planted a tree a long time ago.”

– Warren Buffett

In 1946, the U.S. had ~14 Crore people. Only a few created serious wealth.

India in 2025 is in a similar position. Will your child be one of the few?

Warren Buffett’s Net Worth

- Approx. $156.9 Billion

- In Rupees: ₹13,42,397 Crores (at ₹85.96/USD)

He didn’t win a lottery. He:

- Started early

- Stayed invested

- Let compounding work for decades

Warren Buffet creates such a massive wealth because he is in

Right Place + Right Time + Right Economic Situation

Let’s See how many of us create wealth like Warren Buffet….

Same situation arise in India Lets see how many individuals become at least billionaire. Because ,

We are in Right Place + Right Time + Right Economic Situation

Forget about warren buffet having wealth of approx. ₹13,42,397 Crore.

AsK to MYSELF???

Can we create a wealth of 100 crore with discipline Investment???

Can we invest in asset class that are in bull (either in Price or in Unit)???

Can we take the benefit of power of compounding over time???

If the answer of above question is YES then Wealth is waiting to create….

Timeless Wealth Creation Formula

Plan – Define your legacy goal

Invest – Start SIP or lumpsum with discipline

Hold – Ignore noise and stay committed

Create – Let compounding do the heavy lifting

Behavioral Rules for Success

✅ Stay invested — volatility is normal

✅ Never interrupt compounding

✅ Avoid emotional decisions

✅ Start early + Stay regular + Think long term

Gujarati Wisdom: “ઉતાવળે આંબા ન પાકે”

(You can’t ripen mangoes in haste — just like wealth)

Ask Yourself

- Can I invest with discipline for my child’s future?

- Can I stay invested in the right asset classes for the long term?

- Can I allow compounding to work without interruption?

If the answer is YES, then your child’s ₹100 Crore future is possible.

Final Tip Before You Invest

- Patience pays massively

- 99% will give up before the rewards

- Stay calm, stay regular — and let time do the magic

Final Thoughts

- Creating ₹100 Crore wealth for your child is possible.

- You don’t need luck — just time, consistency, and patience.

- The best time to start was yesterday. The next best time is NOW.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

![]()