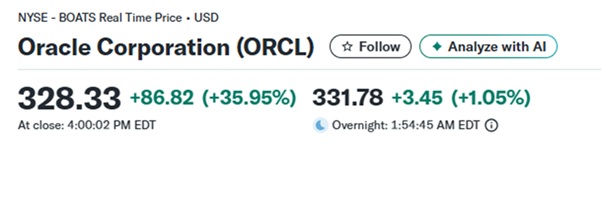

In a dramatic display of market power, Oracle Corporation (ORCL) surged by an extraordinary 34% in a single trading session, driven by explosive growth in its cloud computing division and blockbuster earnings. This surge added nearly $100 billion to Oracle’s market capitalization in just one day—more than the entire market value of many global companies.

The biggest winner? Larry Ellison, Oracle’s 83-year-old founder, who leapt past Bill Gates to briefly become the world’s richest person. But this isn’t just a story about one stock’s rally. It’s a powerful case study in the importance of long-term investing and entrepreneurial perseverance.

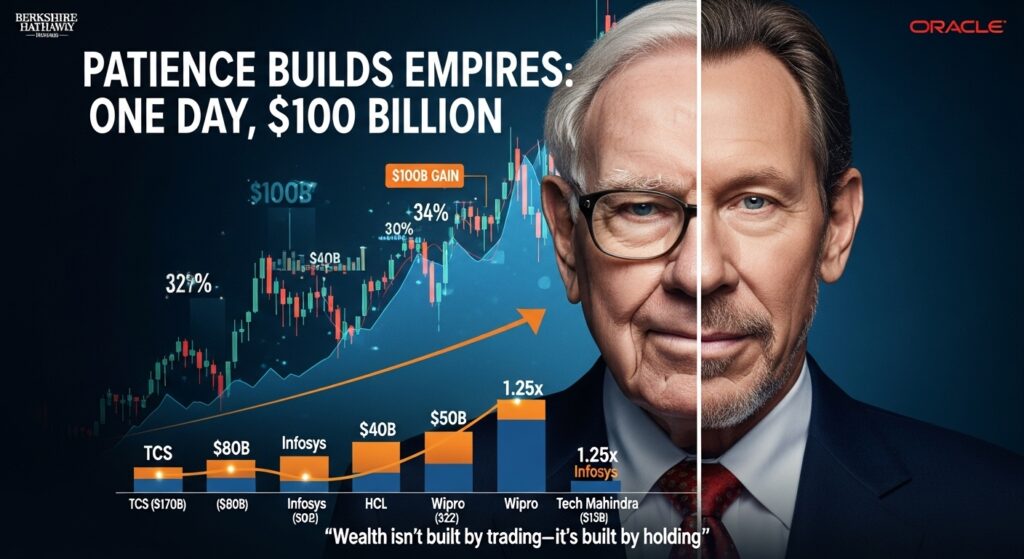

Oracle vs Indian IT Giants: A Scale Perspective

To put Oracle’s $100B gain into perspective, consider this comparison:

| Company | Market Cap (USD Bn) | Oracle’s 1-Day Gain vs. Market Cap |

| Oracle (1-Day Gain) | 100 | 1.00x |

| Tata Consultancy (TCS) | 170 | ~0.59x |

| Infosys | 80 | ~1.25x |

| HCL Technologies | 50 | ~2.00x |

| Wipro | 32 | ~3.13x |

| Tech Mahindra | 13 | ~7.70x |

Oracle’s single-day wealth creation exceeded the entire market cap of Infosys, and dwarfed others like Wipro and Tech Mahindra. This underscores the exponential value that long-term global tech leaders can unlock.

Unpredictable Rewards: Why Time in the Market Matters

For long-term Oracle investors, this wasn’t luck—it was the payoff for patience. Over nearly five decades, the company has weathered downturns, pivots, and fierce competition. Investors who stayed the course witnessed the compounding power of innovation and strategic reinvention.

Oracle’s one-day gain illustrates a key principle: a few trading days account for the majority of market returns. Attempting to time the market means risking missing out on exactly these rare, explosive gains. Staying invested ensures you’re there when these moments of compounding value arrive.

Lessons from the Titans: Ellison and Buffett

Larry Ellison’s journey echoes that of other legendary long-term wealth creators:

- Warren Buffett, through Berkshire Hathaway, built immense wealth by holding quality businesses over decades, reinvesting dividends, and letting value compound.

- Larry Ellison founded Oracle in 1977 with just $1,400. Over the years, he led the company through seismic tech shifts—from relational databases to cloud computing and now AI infrastructure.

Both men exemplify a rare combination of vision, discipline, and patience—the true ingredients of wealth creation.

Final Thought: Patience Pays

Oracle’s surge is not an anomaly—it’s a validation of long-term thinking in both investing and business building. While not every company will become an Oracle, the lesson is clear: time in the market beats timing the market.

Long-term investing isn’t about predicting the next jump—it’s about being invested when the jump happens.

Disclaimer: This article is for informational and educational purposes only and should not be construed as financial advice. All investments carry risk, and past performance is not indicative of future results.

![]()