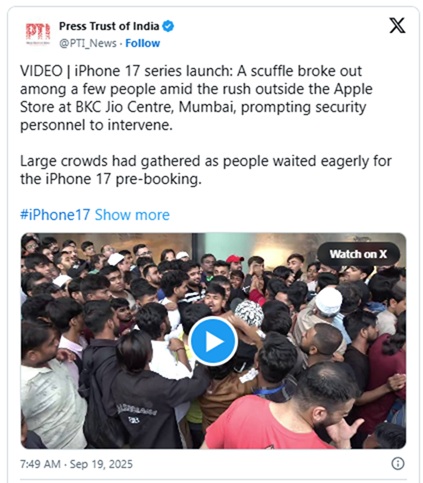

A minor scuffle outside Apple’s Mumbai store at the iPhone 17 launch (₹1.5–2.3 lakh) masks a deeper macro signal: India’s per-capita income is now US $2,878 and closing in on the US $3,000 “tipping point” where global history shows discretionary consumption accelerates.

The $3,000 Benchmark: A Global Playbook

The global economic playbook shows a consistent pattern: once a nation’s per capita income surpasses the $3,000-mark, discretionary spending on premium goods and services sees a structural and often explosive increase.

- China (c. 2008): When China’s per capita income crossed $3,400 in 2008, it entered a golden decade of consumption. Demand for smartphones, automobiles, and international travel skyrocketed. Apple’s success in China is a direct result of this boom, with the country now being one of its largest markets. This was fueled by a massive shift from saving for necessities to spending on aspirations.

- South Korea & Taiwan: These economies exhibited similar patterns in the late 1980s and 1990s, with brands like Samsung and Hyundai becoming global giants on the back of rampant domestic consumption before going international.

- 1st World Comparison: For advanced economies (e.g., US, UK, Japan with per capita incomes above $40,000), consumption of technology like the latest iPhone is a routine part of the consumer cycle, funded by high disposable incomes and readily available credit.

India, with a current per capita income of $2,878 (approx. ₹2.4 lakhs), is knocking on the door of this transformative phase. The demand for a product costing nearly a full year’s average income is a powerful leading indicator of the immense pent-up demand within a large and growing segment of the population.

The Transmission Mechanism: From Layman’s Loan to Investor’s Return

The recent scramble for a ₹1.5 to 2.3 lakh iPhone in Mumbai is a microcosm of this shift. The key driver? Aspirational credit. The “layman” taking loans for premium smartphones, white goods, and vehicles directly fuels corporate revenues for banks, manufacturers, and retailers.

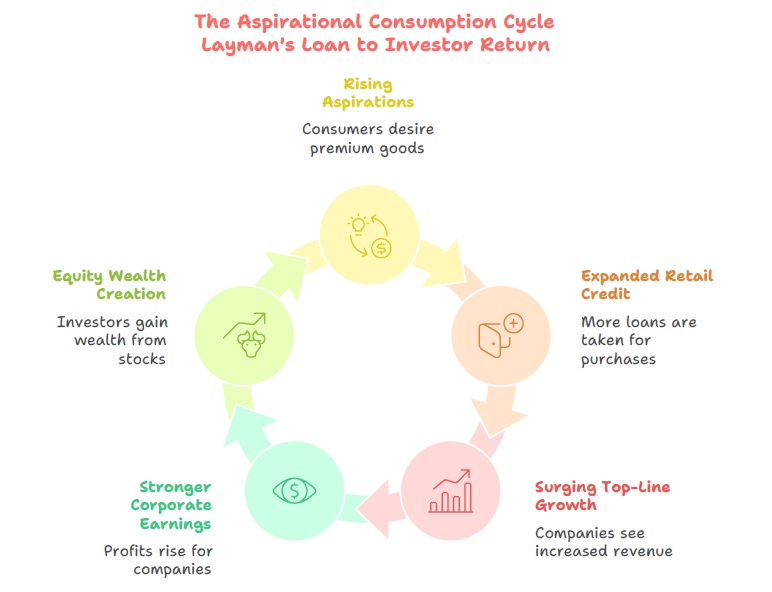

For equity investors, this is the creation of a virtuous cycle: rising aspirations → expanded retail credit → surging top-line growth for consumption-linked companies → stronger corporate earnings → equity wealth creation.

Conclusion: The Window of Opportunity

The scuffle for an iPhone is not an isolated event; it is a signal of the latent demand ready to be unlocked by credit. For equity investors, the coming phase represents a foundational shift akin to the early stages of China’s consumer boom. While risks around credit quality and inequality persist, the structural trend is clear. Capital allocation towards companies facilitating and benefiting from India’s aspirational consumption cycle is likely to be the dominant theme for equity wealth creation in the coming decade. Missing this structural shift in Favor of other asset classes may mean forgoing a generational growth opportunity.

Disclaimer: This article is provided solely for educational and informational purposes. It does not constitute investment advice, a recommendation, or an offer to buy or sell any security. Readers should consult their qualified financial advisor before making any investment decisions.

![]()