Every success—whether on the cricket pitch or in the stock market—is a slog through swings, misses, and hard-earned boundaries. Rohit Sharma’s ascent from a modest Nagpur background to captaincy isn’t just a cricket story; it’s a blueprint for mastering long-term investing with consistency, patience, and the right guidance.

Just as investors accumulate wealth starting with small MF investment like SIPs (Systematic Investment Plans), Lumpsum Rohit accumulated records with careful innings, weathered his share of form slumps (read: volatility), and ultimately compounded his success—proving that greatness is, above all, a process.

Rohit Sharma: Records Are Never Instant

Rohit’s cricketing stats read like a dream—built over years, not tournaments. Here’s why they’re a lesson in compounding returns:

| Achievement | Rohit Sharma Record |

| ODI Double Centuries | 3 (World Record) |

| T20I Centuries | Most by any player |

| IPL Titles (Captain) | 5 (Mumbai Indians) |

| ICC Titles | World Cup Runner-up (2023), Asia Cup Wins |

| Awards | Arjuna Award (2015), Khel Ratna (2020) |

Notice: None of these arrived overnight—each milestone echoes the slow, steady compounding that defines equity mutual funds. The big scores arrived only after years of disciplined net practice—and a straight bat through volatility.

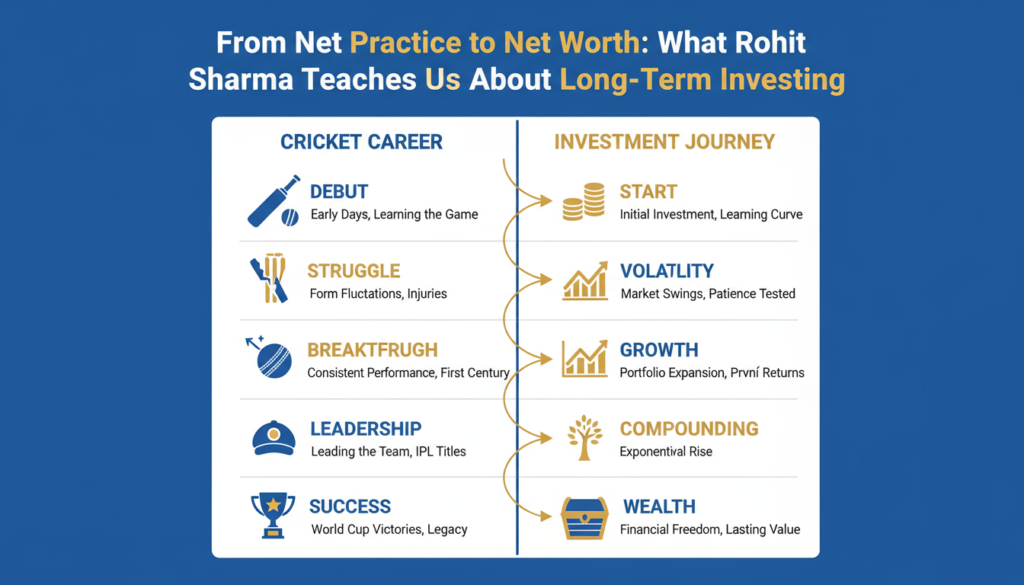

Cricket vs. Investing: Phase by Phase

Here’s how Rohit’s career tracks with the journey of a disciplined investor:

| Phase | Rohit Sharma’s Journey | Equity Mutual Fund Parable |

| Early Struggles | Humble upbringing; reliant on uncle | Small SIPs, shaky market, doubts emerge |

| The Right Coach | Coach Dinesh Lad, scholarship at age 11 | Advisor gives discipline, nudges SIPs, Lumpsum, Financial Planning, Risk Adjusted Return |

| Initial Breaks | U-19 World Cup, T20 debut 2007 | First signs of positive returns |

| Painful Setbacks | Form slumps, missed 2011 WC | Investor anxiety, market dips |

| Investing in Growth | Shifted focus, worked harder | Adjust allocation, stay invested |

| Consistency Rewarded | “Hitman” era, IPL wins, captaincy | Compounding SIPs, wealth creation |

| Accolades | Khel Ratna, world records | Financial goals achieved, long-term gains |

Behind Every Star: The Coach (and the Advisor)

No player—however talented—succeeds alone. The coach in cricket and advisor in finance share a common playbook:

| Coach’s Role | Advisor’s Role |

| Spots strengths, fosters skill | Identifies financial goals & risk appetite |

| Trains for discipline | Ensures SIP regularity & rebalancing |

| Offers focus during slumps | Prevents panic selling in market dips |

| Refines strategy as needed | Adjusts portfolio to market cycles |

Without a coach, even superstar talent can drift. Without an advisor, investors may bail at the first bouncer.

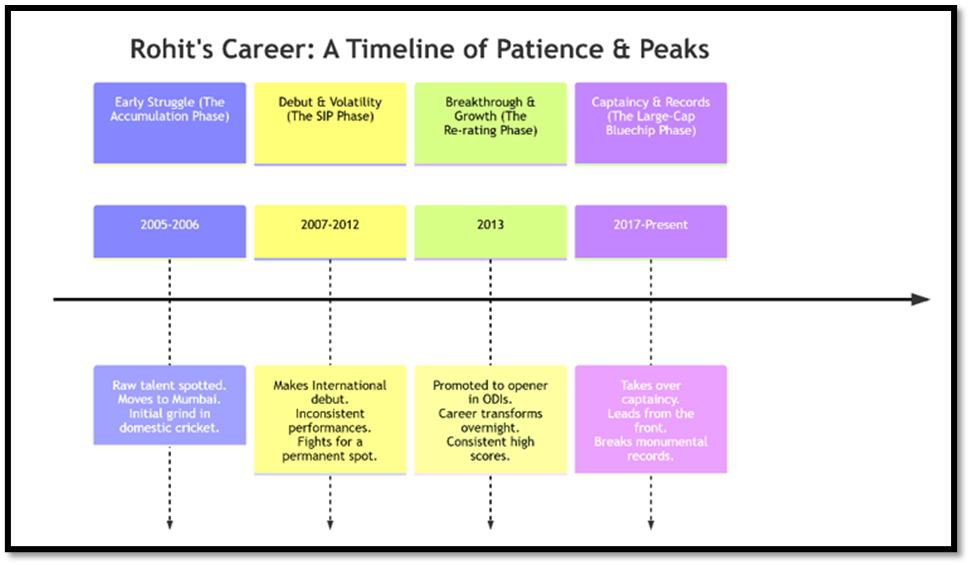

Volatility, Patience & Strategic Shifts

Rohit’s early years in Team India were textbook volatility: flashes of brilliance, interspersed with lean patches. Selectors (read: investors) doubted if the asset was overvalued. Competition was intense—think Sachin, Dravid, Yuvraj, Dhoni—each vying for a middle-order slot.

The game changed in 2013. MS Dhoni—cricket’s answer to a portfolio manager—reallocated Rohit to opener. It was portfolio rebalancing in action: unlocking hidden value from a neglected asset class.

Check out the numbers:

| Metric | Before Opener (2007-12) | After Opener (2013-Present) |

| ODI Batting Average | ~30.43 | Over 55.0 |

| Strike Rate | ~78.0 | Over 90.0 |

| Centuries | 2 | 31 |

| Double Centuries | 0 | 3 (Record) |

This is what smart “asset allocation” looks like in both cricket and your portfolio.

Takeaways: Your Run Chase to Wealth

The analogies are more than skin deep:

| Element | Rohit’s Cricket | Equity Mutual Funds |

| Long-Term Vision | 15+ year career focus | Think 10-15+ years ahead |

| Handling Volatility | Strong head through slumps | Stay invested in market crashes |

| Strategic Move | Promotion to opener | Fund choice + asset allocation |

| The Guide | Coach delivers focus | Advisor provides behavioural coaching |

| Power of Compounding | Records stack up over time | Corpus compounds over decades |

| Legacy/Outcome | “The Hitman”—records, leadership | Financial freedom—secure future |

Play the Long Innings — Rohit Style

Rohit Sharma didn’t become a champion overnight.

His formula for success was simple yet powerful —

✅ Talent

✅ The right guidance

✅ Strategic adjustments

✅ Consistent effort and patience

And the same principles apply to your investments:

• Start early and invest regularly (SIP & Lumpsum)

• Stay patient during market downturns

• Trust your financial advisor (your coach)

• Give compounding the time it needs — miracles take time

💡 Don’t be the investor who rushes back to the pavilion at the first market bouncer.

Play like Rohit — stay at the crease, stay disciplined, keep investing, and build your own record-breaking innings.

Start your SIP today.

Your future self may not hit sixes — but it will surely thank you for the financial centuries you’ve created.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. The article is for informational purposes only and does not constitute financial advice.

![]()