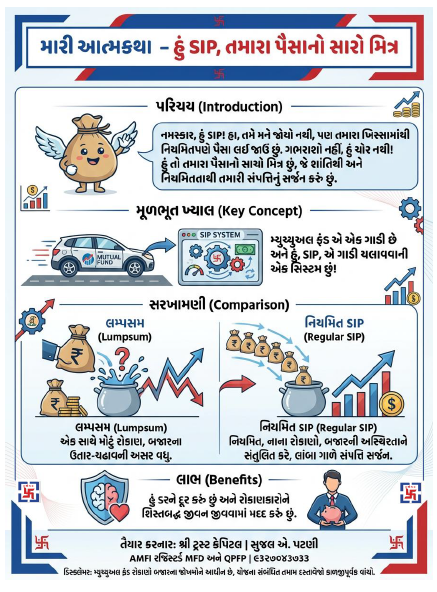

Hello, I am SIP! Yes, you can’t see me, but I regularly take money out of your pocket. Don’t panic—I’m not a thief! I am your money’s true friend, quietly and consistently helping you create wealth with discipline and peace of mind.

Many people ask me, “SIP? Does that mean a mutual fund?” I can’t help but smile when I hear this. Let me clarify one thing clearly: a mutual fund is the vehicle, and I—SIP—am the system that drives it.

Just as you can drive a car at full speed all at once (which is called a “lump sum”), you can also drive it steadily and regularly through me. I remove fear from investing and help investors lead a disciplined financial life.

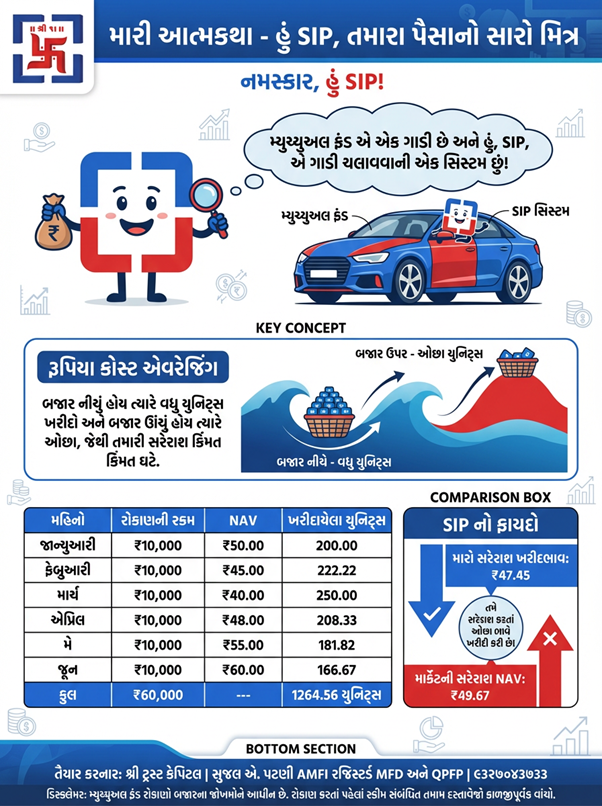

My Favorite Magic: Rupee Cost Averaging

Seeing the ups and downs of the market, many people become anxious. I look at the market as an ocean—sometimes there is a high tide, and sometimes a low tide. I handle this roller-coaster ride of market prices very efficiently. My biggest weapon for this is rupee cost averaging.

My magic is very simple. I do not pay attention to the market’s mood. Whether the market is up or down, I invest a fixed amount at a fixed time. The logic is straightforward: when the market is low (that is, when there’s a “sale”!), mutual fund units are cheaper, so I buy more units. And when the market goes up (prices are higher), I buy fewer units. Over time, this keeps my average purchase cost lower.

In the table below, you can see how I perform brilliantly even amid market volatility.

The Power of SIP in Market Volatility: Rupee Cost Averaging

| Month | Investment Amount (₹) | NAV (₹) | Units Purchased |

| January | ₹10,000 | ₹50 | 200.00 |

| February | ₹10,000 | ₹40 | 250.00 |

| March | ₹10,000 | ₹60 | 166.67 |

| April | ₹10,000 | ₹35 | 285.71 |

| May | ₹10,000 | ₹65 | 153.85 |

| June | ₹10,000 | ₹48 | 208.33 |

| Total | ₹60,000 | 1264.56 |

From the above table, you can see that over six months I invested a total of ₹60,000 and accumulated 1,264.56 units.

- My average purchase cost: ₹60,000 / 1264.56 = ₹47.45

- Average market NAV: (₹50 + ₹40 + ₹60 + ₹35 + ₹65 + ₹48) / 6 = ₹49.67

As you can see, while the average market NAV was ₹49.67, the average cost of the units purchased through me was only ₹47.45.

The biggest advantage of rupee cost averaging is not financial, but psychological. It removes the stress of “timing the market”—deciding when to invest. Many people get nervous watching market fluctuations and keep waiting for the “right time.” This fear and stress can prevent them from investing at all, which hinders wealth creation.

By investing through me, this worry disappears. The investor simply needs to invest regularly, and I take care of the rest.

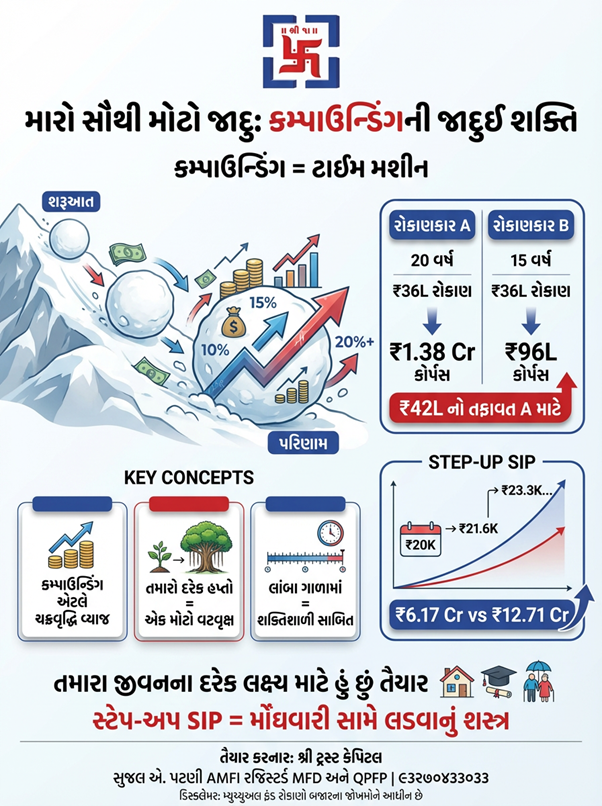

My Greatest Magic: The Magical Power of Compounding

If rupee cost averaging is my powerful weapon, then compounding is my greatest magic. To understand compounding, imagine a small snowball. As it rolls down a mountain, it keeps collecting more snow and grows bigger and bigger. In the same way, my investment keeps growing larger over time. I would even call this snowball a “time machine” that can multiply your money much faster in the future.

Compounding means earning returns on returns. In other words, the returns you earn on your invested amount also start generating returns. When you invest regularly through monthly contributions, each small installment gradually turns into a huge banyan tree, because every installment keeps growing continuously. This process is especially powerful over the long term.

The real magic of compounding is hidden in time. Time is even more important than money, and I will explain this with an example.

The Importance of Time: The Cost of Starting Late

| Parameter | Investor A | Investor B |

| Monthly SIP | ₹15,000 | ₹20,000 |

| Investment Period | 20 years | 15 years |

| Total Investment | ₹36 lakh | ₹36 lakh |

| Total Corpus (approx.) | ₹1.38 crore | ₹96 lakh |

| Difference | ₹42 lakh more! | — |

From the above table, you can see that both Investor A and Investor B invested a total of ₹36 lakh. However, Investor A invested for five additional years, which created a significant difference of ₹42 lakh in the final corpus. This is the true cost of delay—the price you pay for starting late.

I Am Ready for Every Goal in Your Life

I am not just a tool for building wealth; I am also a trusted partner in achieving the major goals of your life. From buying a home to planning for your children’s higher education and retirement, I stand by you at every step.

Retirement planning is my favorite project. Many people believe that accumulating a large retirement corpus is very difficult, but I make it simple. However, there is one major challenge in retirement planning: inflation. The ₹12,000 monthly investment you make today will not have the same value after 30 years.

The solution to this problem lies in my smartest version: the Step-Up SIP. A Step-Up SIP helps you keep pace with time. As your salary increases, you can gradually increase your monthly investment as well.

For example, if you start a monthly SIP of ₹20,000 at the age of 30 and continue it regularly for 30 years, you can build a corpus of ₹6.17 crore. But if you increase this investment by just 8% every year, the same investment can create a corpus of ₹12.71 crore. This approach helps your investment grow faster than inflation. Therefore, for retirement, regular investing alone is not enough—your investment must also grow over time.

Market Volatility: Don’t Panic, Stay with Me!

How do I feel when markets become turbulent and investors panic? I smile and say, “My friend, I was created precisely for such situations!” I am designed to handle market ups and downs.

When markets fall and everyone panics and stops investing, I calmly keep buying more units. A market decline means units have become cheaper—this is like a “sale” for me. If an investor stops their SIP at such times, they miss the opportunity to benefit from lower prices.

Market volatility is not a loss; it is an opportunity. To take advantage of this opportunity, patience is essential. Stopping an SIP in panic can be harmful in the long run. It leads to missing the chance to buy more units at lower prices, keeps the average purchase cost higher, reduces the benefit of compounding, and ultimately results in a smaller corpus. Therefore, continuing to invest under all circumstances is the true path to wealth creation.

I Am Not Alone—I Have Many Forms

Investors have different needs, which is why I come in many forms:

- Regular / Fixed SIP: This is my simplest and most popular form. You decide a fixed amount and a fixed period, and I invest regularly as per that plan.

- Flexible SIP: In this form, investors can increase or decrease the investment amount as per their convenience. It is ideal for those with irregular income.

- Step-Up SIP (Top-Up SIP): One of my most powerful forms. Here, investors increase the investment amount annually. This is my strongest weapon against inflation.

- Perpetual SIP: In this form, I continue investing until the investor asks me to stop. It is ideal for long-term goals, as there is no predefined end date.

- Trigger SIP: This form is meant for investors who understand markets in depth. Investments are triggered only when a specific market event occurs (such as a sharp market correction).

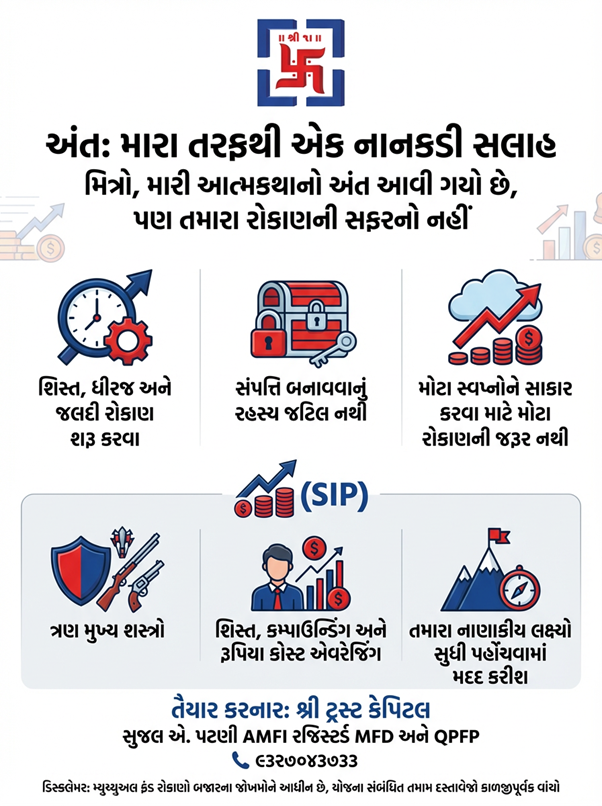

Conclusion: A Small Piece of Advice from Me

Friends, my autobiography comes to an end here, but your investment journey does not. The secret of wealth creation is not complicated. It is based on discipline, patience, and starting to invest early.

I (SIP) am always ready for you. You just need to take the first step. With my three core strengths—discipline, compounding, and rupee cost averaging—I will help you reach your financial goals. Remember, achieving big dreams does not require big investments, but regular and well-informed investing.

Disclaimer: Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully.

![]()