we have heard: “Stay invested for the long term.”

But… where, exactly? And for how long?

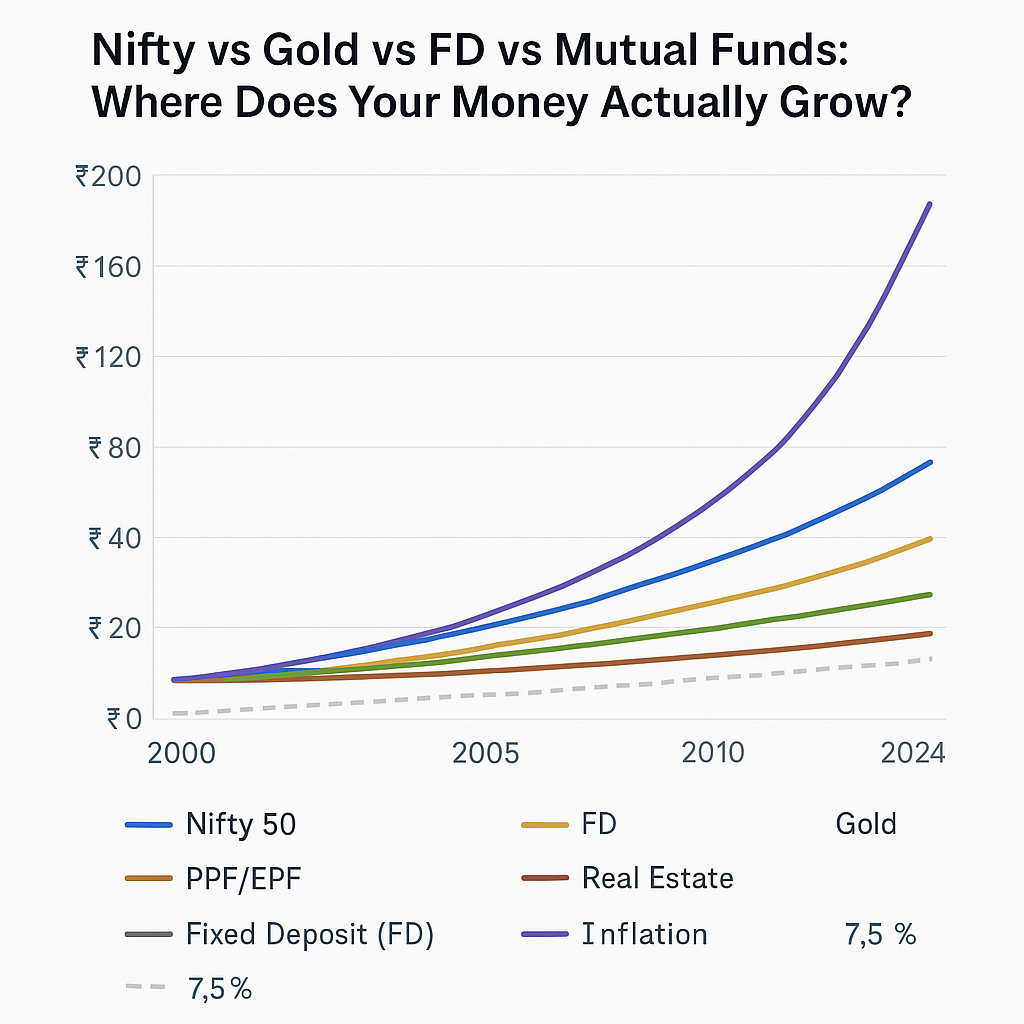

Let’s analysed how ₹10 lakhs invested across six major asset classes would have grown from 2000 to 2024:

- Nifty 50

- Gold

- Fixed Deposit (FD)

- PPF/EPF

- Real Estate

- Diversified Mutual Funds (with 4% alpha over Nifty)

And I added a 7.5% inflation line as the real benchmark.

1️⃣ The Growth Engines – What You Earned (CAGR)

| Asset Class | CAGR (2000–2024) |

|---|---|

| Nifty 50 | 11.2% |

| Gold | 11.5% |

| FD | 6.5% |

| PPF/EPF | 8.0% |

| Real Estate | 8.5% |

| Mutual Fund (Nifty 50+4%) | 15.2% |

| Inflation | 7.5% |

📉 If your investment earns less than 7.5%, you’re not growing wealth — you’re just delaying erosion.

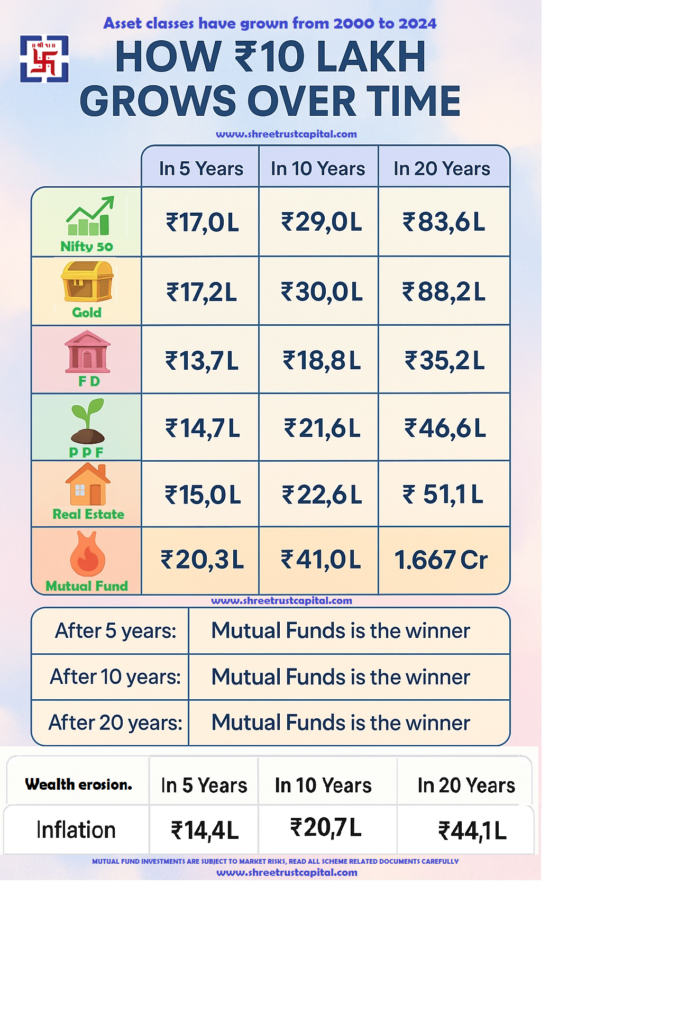

2️⃣ What Happens to ₹10L Over Time

In 5 Years:

✅ Only Nifty, Gold, Real Estate, and Mutual Funds beat inflation. But Winner is Diversified Mutual Fund.

| Asset | Value (₹) |

|---|---|

| Nifty | ₹17.0L |

| Gold | ₹17.2L |

| FD | ₹13.7L |

| PPF | ₹14.7L |

| Real Estate | ₹15.0L |

| Mutual Funds | ₹20.3L |

| Inflation line | ₹14.4L |

In 10 Years:

❌ FD fails completely. PPF barely survives.Equity starts to pull away. Diversified MF clear Winner.

| Asset | Value (₹) |

|---|---|

| Nifty | ₹29.0L |

| Gold | ₹30.0L |

| FD | ₹18.8L |

| PPF | ₹21.6L |

| Real Estate | ₹22.6L |

| Mutual Funds | ₹41.0L |

| Inflation line | ₹20.7L |

In 20 Years:

| Asset | Value (₹) |

|---|---|

| Nifty | ₹83.6L |

| Gold | ₹88.2L |

| FD | ₹35.2L |

| PPF | ₹46.6L |

| Real Estate | ₹51.1L |

| Mutual Funds | ₹1.67 Cr |

| Inflation line | ₹44.1L |

❗ Even Real Estate fails to beat inflation meaningfully.

🧠 Mutual Funds (with 4% alpha) beat inflation by over ₹1.2 Cr.

3️⃣ The Silent Killer: Inflation

We obsess over market crashes.

But inflation compounds against you — quietly. No alerts. No headlines. Just erosion.

📉 At 7.5%, your ₹10L loses half its value every 10 years.

By year 20, it feels like ₹2.5L in today’s money.

4️⃣ The Real Alpha: Not Just 4% but in value it’s too big.— It’s 20 Years of It

That tiny 4% alpha from a good mutual fund?

- Nifty: ₹83L

- Mutual Fund: ₹1.67 Cr

Same ₹10L.

Different mindset. Different vehicle.

💡 Key Takeaway:

“Inflation is the one drawdown you can’t recover from.”

Markets crash and recover. Capital can grow.

But time — and lost purchasing power — never comes back.Looking at your equity portfolio every day is like watching a heart monitor—every blip feels like a crisis. Check it monthly, and it’s more like a rollercoaster—thrilling, but manageable. But zoom out to years, and it’s a scenic highway—smooth, steady, and heading upward. The secret? Wealth isn’t built in the noise of daily moves—it’s in the quiet power of time and compounding.

Disclaimer: This content is for educational purposes only. Consult your financial advisor before making any investment or financial decisions.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

![]()